Skot Waldron:

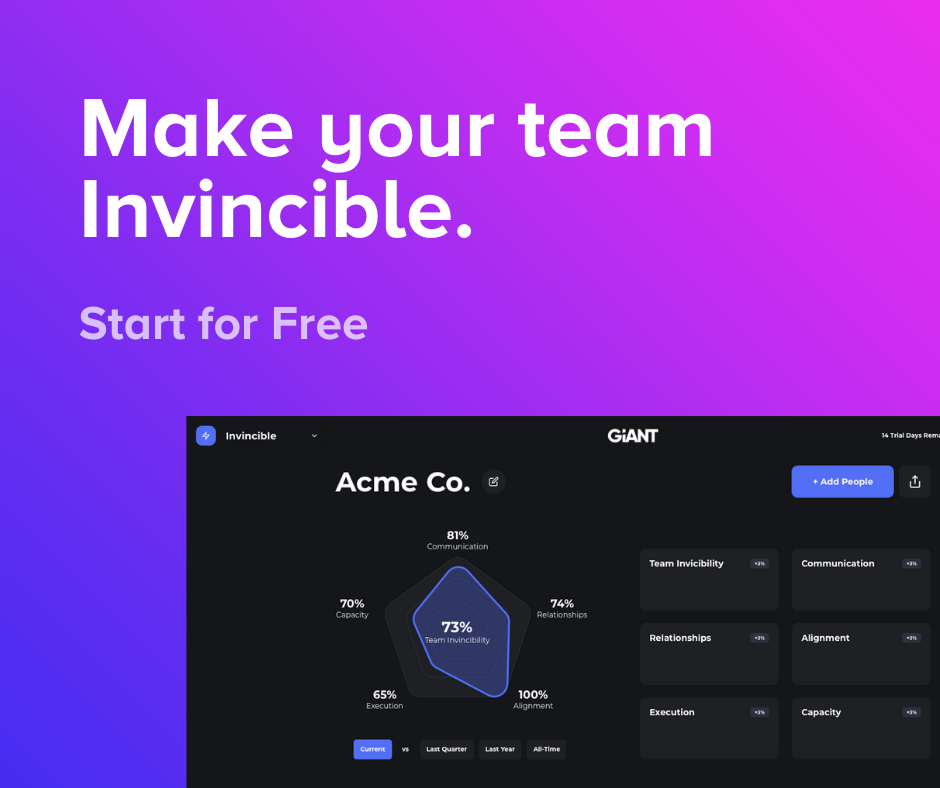

Unlocked is brought to you by Invincible and program designed to unlock the potential of people and teams inside your organization. Join companies like Pfizer, Delta, the CDC, Google, and Chick-fil-A and others in over 116 countries that are currently using this program to increase productivity and develop healthy cultures, access hundreds of hours of content that is accessible anytime, anywhere, and finally, use real time data to understand the health of every team inside your organization, which teams are performing, which ones aren't. Then understand the why behind that performance. Get free access to invincible for 30 days by visiting www.giant.tv/thirtydays.

Hi, everybody. Welcome to another episode of Unlocked. I am Skot Waldron, and today we're going to talk about unlocking the potential of ourselves as leaders and our decision making process, because it is so critical. Linda Henman is on the show today. She's just finished a book called Risky Business. It's her seventh book, so she's kind of good at this. She has been in this space for 40 years, helping leaders make decisions that they have to get right because they cannot afford to get them wrong. She has never had a deal fail in her M&A experience. She has helped companies as big as 30 billion, like Tyson foods, all the way down to 30 million create better decision-making processes in order to have a successful M&A process go through.

So I'm excited about this interview. We're going to talk about a lot of different aspects of what it takes to make good decisions and how we as leaders can avoid making bad decisions. So that's really important. If you're into that, then listen up. Let's go.

Linda, welcome to the show. It's so good to have you. I'm really excited this interview today.

Linda Henman:

Thank you, Skot Waldron. I'm very happy to be here today.

SKOT WALDRON:

So let's talk about you first and what you do, where you are in your life in this space and what you're doing, and give us a quick background on that and give us a quick synopsis of your new book, Risky Business.

LINDA HENMAN:

Well, I'd be happy to do that. I'm my favorite topic of conversation. I started out as a consultant many years ago, more than 40 years ago, working with the Air Force as they transitioned women into roles that they never had before. And that as a matter of fact, is the way I begin Risky Business, of talking about a disruptive mindset that the military had adopted back in 1978.

So picture this, I was a young woman who had no experience in a uniform. I had never led anything other than the prom committee, and I was in charge of helping these chief master sergeants who had so many stripes that I got vertigo looking at them, roughly the age of my father, and I was in charge of facilitating this meeting with them to help them decide how the disruption in the military was going to go then. Now this is post Vietnam, so lots of changes were going on. So that's how I got my start.

Since then, I taught at all levels for many years and did consulting as it came to me. I've been doing it in earnest since 2000. Worked for a firm and then went out on my own, and I've been on my own since 2004. So I've built a business about helping leaders make decisions, pivotal decisions, ones that they can't afford to get wrong. So recently I've written seven books, and the seventh of them, Risky Business: Why You Must Develop a Disruptive Mindset, is just out, hot off the press two weeks ago. In it I talk about how leaders have to do things differently now that we are emerging from a pandemic. Surviving is the first step, but only those who truly embrace the change and the disruption that the pandemic has brought will thrive in the new economy.

And I tell people all the time, this is the latest crisis, but there's another one on the horizon, and if we don't learn some important lessons this round, then we are doomed to repeat the same mistakes next time and maybe not survive the next one. So we learned a lot of lessons that after 9-11, we're learning lessons now as we get back into the office and get back to work, but there are still a lot of work we need to do in terms of developing the mindset that will help us thrive in a new economy.

SKOT WALDRON:

Very good. So you help leaders make tough decisions, which we know we all have to make them at some point in time, and they're scary, and they're intimidating. What would you say causes leaders to make bad decisions?

LINDA HENMAN:

Well, it's several things, but the overarching one is fear. That when people won't make a decision or they make a decision that's too cautious, it's because they're scared. And what are they afraid of? Well, fear comes in three major categories. The first one that I see at the top of organizations with CEOs and business owners is a loss of control. They fear that if they don't micromanage, if they don't stay involved in every decision, if they delegate too much too soon to the wrong people, that they will lose control of the situation and their business. And what they realize is that by holding the reins too tightly, they really are hampering themselves, their development, the development of the company and the development of those on the bench. So fear of loss of control is the number one that I see.

But close behind and that I see among CFOs and many people making financial decisions and people running HR is they fear criticism of their work. So they're slow. They're process-driven. They take too much time because they are seeking perfection. Well, we're never going to be perfect. And what I tell them is when you're 80% ready, go, because what you lose in terms of traction, market shares, sales, whatever, however you're measuring your success, to get that 20% towards perfection, and you'll never get to perfection, but maybe you'll get 5% more, that doesn't equate to what you have lost in terms of opportunity.

And the third fear that I don't see at the top of organizations so often, but I see among those in middle management, that is fear of rejection. That they don't want to make a decision that will make people not like them. So fear of loss of control, fear of criticism and fear of rejection are the three fears that cause people to either not make decisions or make bad decisions.

But in a more general sense, often I find leaders cannot make dispassionate decisions. They become emotional. So they are often, if you're running a company, you're probably a fairly smart person. You were smart enough to know what it takes and to get educated enough and to hire people to help you build your business. But often you can get distracted by your own emotions. And this is disastrous for a leader. And that's where I come in, as the decision catalyst, that I try to help them untangle the situation and look at it from a variety of perspectives. But we are not teaching critical thinking skills in the schools anymore. And so this is a dying art or skill. And I am seeing it, even though people will score in very high numbers on the cognitive measures that I give when I do succession planning or preemployment, they will have very high cognitive scores, but they have really not learned logical decision-making. And it's really creating an Achilles heel for many of them.

SKOT WALDRON:

That's interesting. I've never really heard about that angle of things before. How does that play into, so you've worked a lot in the M&A space, the mergers and acquisitions space, and with large companies, midsize companies, how has that played out in those mergers or those acquisitions with business decisions? In a good and a bad way, I guess, that fear or that decision-making process for the good or the bad?

LINDA HENMAN:

Well, once again, it's emotion. And when you're talking about a M&A deal, there are so many emotions running a muck, and there is a loss of dispassionate thinking. So if you happen to be a small mom and pop kind of business, and you're selling, you have probably a great deal of guilt about selling, because this is the business that your parents started, or maybe your grandparents started this business, and now you're a baby boomer and you want to sell because it's time for you to retire and nobody in your family can take over this business, or nobody wants to take over this business. So I see a lot of guilt of, I took this baby and now I'm selling it on the open market. So there's a lot of that.

Then there's a fear of protecting employees. This person's been with me for 25 years. This person helped my dad start the company, and now this person is not going to have a job. A fear of financial loss, if I sell now, am I going to get the maximum price? Am I going to protect my family? And my family's wealth that my grandparents and parents helped me build. So lots of emotion there.

On the buyer side, and usually I represent the buyer in M&A deals, is they are afraid of getting it wrong because what do the statistics tell us? 75% to 90% of M&A deals fail to deliver on a thesis. That doesn't mean that they go out of business. It means that they're not as successful and they most importantly fail to make money right after the deal closes. So that sort of fear of are we going to be another shipwreck on the shore of M&A deals becomes very daunting, and so it immobilizes people who won't go for it, where they just would need to do a little bit more due diligence and we need to do a little bit more of looking at things, which I'm in favor of, but at some point you just have to take a risk.

SKOT WALDRON:

That is powerful. I love that because it sounds a lot like you're talking about mindset, which you also write a lot about in your books and you talk a lot about, so I'm there with you, right? The mindset thing is super powerful. And I was coaching somebody yesterday on a call and she was talking about honestly, some issues with her teenage son, and some expectations she had for father's day and it didn't work out the way she wanted it to and all these other things. And she just wanted, it was so frustrating for her. We got deep into this topic of mindset because it really came down to that, when you get, and I think a lot of what we do in business comes down to mindset. So let's talk about that aspect of mindset. How does that play into what you're talking about with the M&A deals or with fear and leadership and with all those aspects of what we do in our companies?

LINDA HENMAN:

When I talk about mindset, I talk about five different aspects of what happens between the ears of decision makers. First of all, what is the belief? So beliefs have to do with your values, what do you believe is right? What do you believe is wrong? Ethical, unethical, moral, immoral. That's your foundation of what are you made of, but more importantly, or just as importantly, is what you believe about yourself. Are you optimistic? Do you believe you will figure out the next thing that comes along? Do you trust yourself or do you second guess yourself? Do you have low self-esteem and lack confidence? If you don't have a strong belief in yourself and your ability to make a good decision, you probably won't make a good decision. And closely aligned to that is our emotions.

We talked about fear already, but other emotions too. I mentioned guilt, especially with an M&A deal and selling the company that somebody else created, that you inherited. Many other kinds of emotions there that can run a muck. Self-regulation becomes very important. Who's in charge of you? Are you self-aware? Do you know yourself? Do you understand your emotions? So that's going to play into mindset. And when you're talking about a teenage boy, let's face it, their emotions and their cognition are worlds apart many days. And that's just because it's the nature of the adolescent. Then I mentioned cognition. Do you have the intellectual horsepower to make this decision? So in M&A deals, I encounter many times, especially in terms of a seller of somebody who has a great track record of running the company that somebody else started, but maybe not the advanced training, education, and cognition to make M&A decisions. And that's when you need outside help.

When I'm dealing with a seller, I advise them to go find the most creative investment banker they can to help them with the cognition, to help them understand how to make the decisions. And then of course, I tell them to hire me because I will help them with the decisions too. So that the cognition.

Motivation influences our decision-making. What is your motivation? Why are you motivated? If you go back to the fear, oftentimes we're motivated to avoid pain, but we are also motivated to seek reward and pleasure, and then resilience. How well can you bounce back? There will be disappointments, no matter what the decision is, there will be disappointments. So do you have a network of support, either in your business, in your family, among your friends, at your church, we need support and we need help in bouncing back. So those are the five things. We've got to have the right belief system. We've got to be in control of our emotions. We have got to have the horsepower or be able to hire the intellectual horsepower to help us with our decisions. We've got to be motivated, and we have to have the ability to bounce back.

SKOT WALDRON:

You talk about in M&A deals, you talk about when selecting new CEOs or often when that CEO tends to hire a clone of themselves, right? Even if the company of the future needs something different, or also they see an M&A deal as a technical thing, is just a transaction that happens, forgetting that the people in the culture may clash, when you look at those things coming across. So we've talked about mindset, we've talked about trying to avoid bad decisions. How do those aspects of people and culture and chemistry work within the M&A space? How do you help people manage that part of the decision-making process?

LINDA HENMAN:

Well, it all starts and stops with the decision-making and the decision maker of the most powerful person who's making the decision. So the buyer, the seller, the CEO, the outgoing CEO, the incoming CEO. So when companies hire me to select a new CEO, sometimes they'll say, "Here's who's on the bench. Can any of these people run the organization?" And usually not. Usually if they're hiring me it's because they have questions. And so I'm thinking about a family owned business that the parents wanted to retire. And they said, "Look at our four sons and see if any one of these men can run the company." Well, they couldn't. And the parents knew that deep down. That's very difficult to go back and say your sons, even though they want to take over this company, they can't. So what am I looking for then?

The number one thing I'm looking at is does this person have the critical thinking skills to which I alluded earlier to run this new, more complex combined company, if it's an M&A deal, or the company of the future, if it's simply a succession plan that we're working on. So whether I'm working with a board of directors to help them as select CEO or a family owned business, to help them select the future leader of the company, the number one thing I want to know is can this person analyze information, see patterns, and get to the core of complicated problems, because the future is going to be more complex than the past. So the way we've always done things around here is not going to be the way you're going to need to do things in the future, and that is that the essence of the culture of the organization.

So then I ask what has to stay the same and what needs to change? So adaptability is at the core of culture. How does your company adapt? And adaptability has to do with, how do you learn? How do you grow? How do you change? And most importantly, how do you respond to customers? Because what did we learn during the pandemic? I couldn't be in the office with my customers. They weren't there either. Everybody was working from home. So we all learned to use Zoom. We all learned to rely on email and phone calls, and we all learned a new way of doing business so that we could all keep our businesses going. I needed to keep my business going. They needed to keep their business going, and they needed my help for doing certain things. So we learn new ways. I learned new ways to be responsive to my customers and in turn, help them discover new ways to be responsive to their customers.

So that's adaptability, and that's at the heart of culture, but so is consistency. And this may seem as though I'm setting up a conflict, but I'm not. Some things need to change regularly. Like customer focus, adaptability in the market, response to competitors winning moves. Those things have to change every year, forever, and sometimes monthly, and sometimes weekly. Some things should never change. And that would be core values or mission. So why are you in business? What do your customers expect from you and who would miss you if you went away? That's your mission. Why do you even have a company? And what are your core values? Those don't change when there's a pandemic. And those don't change when there's a new political party, that's running things. Those things should never change. So we think of culture as consistency, but really culture is about the balance of consistency and adaptability.

SKOT WALDRON:

I talk about brand a lot and the key components of brand are consistency, that's one of my biggest ones that I talk about all the time, we talk about consistency in image, consistency in language, consistency in how we present ourselves to the world from an external standpoint, but also an internal standpoint. Leaders need to be consistent in the way they address certain needs, right? In the way that they deal with change and the way that they deal with difficult times. That consistency is going to be very important to building trust. And alignment is another thing that we talk about a lot in the brand space of alignment. Now, alignment externally is important, but alignment internally, making sure that we're aligned as a company on what we're trying to do moving forward. So I can imagine that's a big deal in the M&A space, right? Is there alignment there? Is there something that, hey, you're with me on this, we're kind of jelling together, and that builds culture because misalignment is really going to tug at both sides if there is some breakdown in that. Have you seen that happen in your career?

LINDA HENMAN:

I have, we're both using the word consistency, but there are two other words that we need to interject into this conversation. They are trust and predictability. That when people are consistent, we learn that they are predictable. And that doesn't mean they won't change, but we know that they are going to be predictable in that if I'm a customer, you are going to respond to my needs and you are going to respond to what I need, how I need to do business with you. But the other is that builds trust because you can always, because you've always been responsive to me, if I'm your customer, I trust that when the next thing comes along, that you will be responsive to me because you care about me as an employee, as a team member, as a customer, I need to trust you. And the way I trust you is predictability.

SKOT WALDRON:

It's so true. In every relationship, right? Whether it's a spouse or whether it's a colleague at work, and that predictability builds a lot of trust. And as soon as we start seeing those inconsistencies, we start like little flags go up, right? We started to build up this wall, what we call a wall of self preservation, because I'm afraid of how you're going to react to me next time that happens, or I don't know what's going to happen, so I'm going to protect myself in some way, shape or form. And that plays a lot into the culture of what we do. You talk about one of the biggest mistakes companies make is being that they respond to culture that evolves instead of proactively influencing the way that it will change. What is, as we wind down the interview here, what is that big tip that you can give us for being proactive? Being intentional about influencing the way that our culture evolves as we move forward?

LINDA HENMAN:

Well, it was very timely that you would ask that, Skot Waldron, because I'm getting on a plane for the first time to go to a client next week, to help them with a culture survey. This is two construction companies, two billion dollar construction companies that came together to form a $2 billion enterprise. And each of the companies had an independent culture. One is in St. Louis and the other is in Austin, and they'd come together and they need to create a culture of that as an enterprise wide culture, not just a culture of each of these two entities that came together. And the way I help companies with this is first of all, I just survey people. I find out what perceptions are and different ways of measuring this kind of thing. I use the Denison culture survey as the foundation of this, and the survey gives the data, but it's the conversation that we will have when we are in session next week that will really move the needle on this.

Because every time I've done this, the leaders have been surprised at something. When we reviewed the data before the session, they say, "What's going on here?" I said, "I don't know. We won't know until we get in and simply ask people." So you need to measure, in some way, you don't have to use the Denison survey, that's just the one I prefer, but you need to understand the perceptions of the people in the organization, and then you can take steps to changing your objectives and your strategy. But if you don't know what you've got to start with you, it's very unlikely. You're going to make changes in a way that will be beneficial to the company.

SKOT WALDRON:

Well said. I think that that's going to be really important. I love the intersection of data, right? Quantitative, qualitative analysis, to understand and get to the root of certain things. And I love that there's companies invested in really understanding that. The data can give us some numbers and give us some interesting things to go, oh, that's that aha moment of, oh, wow, well, let's dig deeper on that and then we can really find out the source of what's going on. So I love that you do that. Good luck on that. Good luck on your plane trip, as we get back into this new, weird world of flying again.

LINDA HENMAN:

Well, I'm hoping I have well behaved passengers surrounding me.

SKOT WALDRON:

Yeah, yeah, exactly. Yeah. We just got back from a trip this week and after wearing a mask for eight hours, I was like, I haven't worn a mask that long ever, and it was horrible. So hopefully your flight isn't that long, but I really appreciate you being on the show. Good luck with Risky Business. What can people do to get ahold of the book or get in touch with you?

LINDA HENMAN:

Well, here's the copy of the book.

SKOT WALDRON:

Nice.

LINDA HENMAN:

The easiest way to get it is to go on Amazon or Barnes and noble.

SKOT WALDRON:

Okay. Easy enough. We've all heard of those, I believe, so that's good. That's good. What about getting in touch with you? If we want to understand more about what you do, how you can help the audience? What can we do there?

LINDA HENMAN:

Certainly I invite everybody who is viewing this to go to my website at www.henman, H-E-N-M-A-N, henmanperformancegroup.com. When you're there, you will find many articles on different subjects. I think, I don't know how many hundreds I have now, but a lot of articles there. You will see links to the six other books that I have written, and you can sign up for my free newsletter and it just takes a click of a button. And I don't get any information from you or I won't hound you if you sign up for my newsletter or anything like that. I would just be happy if I can help you in growing your company and recovering from our current unpleasantness.

SKOT WALDRON:

Linda is so awesome. She has so much to provide. Lists, she provided a lot of good lists for us. So the fear list, right? The loss of control, fear of loss of control, fear of criticism of our work, fear of rejection. How many of us can say that we've ever felt any of those fears? Yeah, I think so. We have all experienced that and it's prevented us from taking action and for moving forward. The other list that she went through was about mindset. A belief, right? A belief in ourselves, confidence, emotion, that emotional thing about decision-making and how that plays into what we do. Cognition, making sure that we have the critical thinking skills, making sure that we are doing the things to, to better our minds, to make sure that we are prepared for those types of things we need to do going forward. Motivation, understanding our motivation. Don't we need to be there and to be motivated to have the drive. And then resilience, being able to get back up after we've been knocked down, those are the things that are going to help us move forward. Those are things that are going to help us build trust with our individuals that we lead.

So it's so critical that we get into this mindset of us as leaders, as us as organizations, that we can go and do better things. We can make good decisions. We have the ability. Sometimes we just need somebody to help move us along and some tools to help do that. So thanks Linda, for being on the show, y'all go check out Risky Business and check out Linda's website. If you want to find out more about me, go to my website at Skot Waldronwaldron.com. You can find out more about me on YouTube. I've got a ton of leadership resources and team communication resources there, where you can learn about that. And you know, like, subscribe, comment, all those things. I'd love to hear from you. So thanks again for being on another episode of Unlocked and we'll see you next time.

Want to make your culture and team invincible?

You can create a culture of empowerment and liberation through better communication and alignment. We call these invincible teams. Make your team invincible through a data-driven approach that is used by Google, the CDC, the Air Force, Pfizer, and Chick-fil-A. Click here or the image below to learn more.